This spotlight presents the top strategies for improving finance and risk management, including addressing limited access to financial services to expand capacity and manage economic and climate-related shocks.

These findings represent survey input from 98 participants working in food security across 20 of the 22 UN Statistical Division geographical regions. In the Regional Breakdown of Results section, responses are grouped into three clusters by Human Development Index (HDI) based on the geographies of participants’ work: Less Developed Regions, More Developed Regions, or Most Developed Regions. For more information on our methodology and the full list of challenges and strategies, see the Feeding the Future main report.

While they can certainly be viewed as discrete obstacles, both finance and risk management also act as cross-cutting enablers—foundations that can reinforce or unlock progress across multiple dimensions of food system resilience. When credit, savings mechanisms, or risk-management tools are out of reach, communities are unable to build, access, and scale promising solutions. Across all development region clusters, Finance and Risk Management was ranked second through fourth out of six challenge options. The pattern suggests that many saw it as a complementary priority—something that enhances other areas rather than competing with them, reflecting its transversal role in enabling both innovation and resilience.

Overall Top Strategies for Finance & Risk Management

#1 Increase geographic equity in public procurement contracts with major food suppliers

In many markets, one of the largest individual purchasing entities is the government. Because of their significant purchasing power, public procurement contracts have the capacity to shape food systems, including food supply and quality for different regions. Public procurement that is deliberately designed to prioritize diverse and nutritious supply can expand market opportunities while improving the availability and quality of food in underserved regions. This strategy may also help reduce perceived investment risk by creating stable and predictable demand for suppliers, strengthening local markets and encouraging broader financial engagement in the food sector.

#2 Increase transparency and accountability in decision-making around government food system administration

A second emerging theme concerns how the public sector interacts with food systems. In response to this challenge, participants appear to recognize that responsible institutions are essential to building effective and inclusive financial markets. Transparency and accountability in decision-making are necessary conditions for creating an enabling environment in which those markets can flourish. Greater openness reduces perceived risk, lowers uncertainty about rules and interventions and encourages investments, helping deepen financial markets.

#3 Develop new mechanisms to identify and prioritize climate-resilient investments

The bidirectional relationship between climate change and food systems is well known: food systems can either contribute to environmental degradation or help preserve ecosystems, depending on how sustainably they operate. At the same time, climate change threatens the stability of food production, particularly for vulnerable populations. This relationship is visible in finance as well. In order to expand economic capacity and mitigate risks, markets need better signals to identify which food systems investments will stand the test of time amidst a warming world.

#4 Increase targeted training and technical support to farmers to promote climate-smart practices and resilience

While the previous strategy focused on investment and capital access, this one shifts attention toward everyday practices at the farm level. Targeted training and technical support help farmers adopt climate-smart approaches such as improved water-harvesting systems, drought tolerant seed varieties, conservation tillage, or more eco-friendly fertilizers. This fourth most-popular strategy reflects an understanding that resilience and risk management is built both through financial tools and through the widespread adoption of practical, sustainable techniques that reduce vulnerability on the ground.

#5 Provide financial and technical assistance for suppliers to stock affordable fresh food in food deserts

Similarly, providing financial and technical assistance to suppliers is critical because access to affordable fresh food in food deserts is shaped by structural constraints on small retailers. Research on neighborhood food stores shows that high upfront costs, limited access to credit, lack of refrigeration, and low purchasing power make stocking fresh and perishable food financially risky. Targeted financing combined with technical support on inventory management and sourcing directly addresses these barriers. By lowering spoilage risk and improving suppliers’ ability to buy and store fresh products, this kind of support makes healthy food provision economically viable. At scale, linking finance and storage capacity helps stabilize local food supply and expand access without relying solely on price subsidies or emergency interventions.

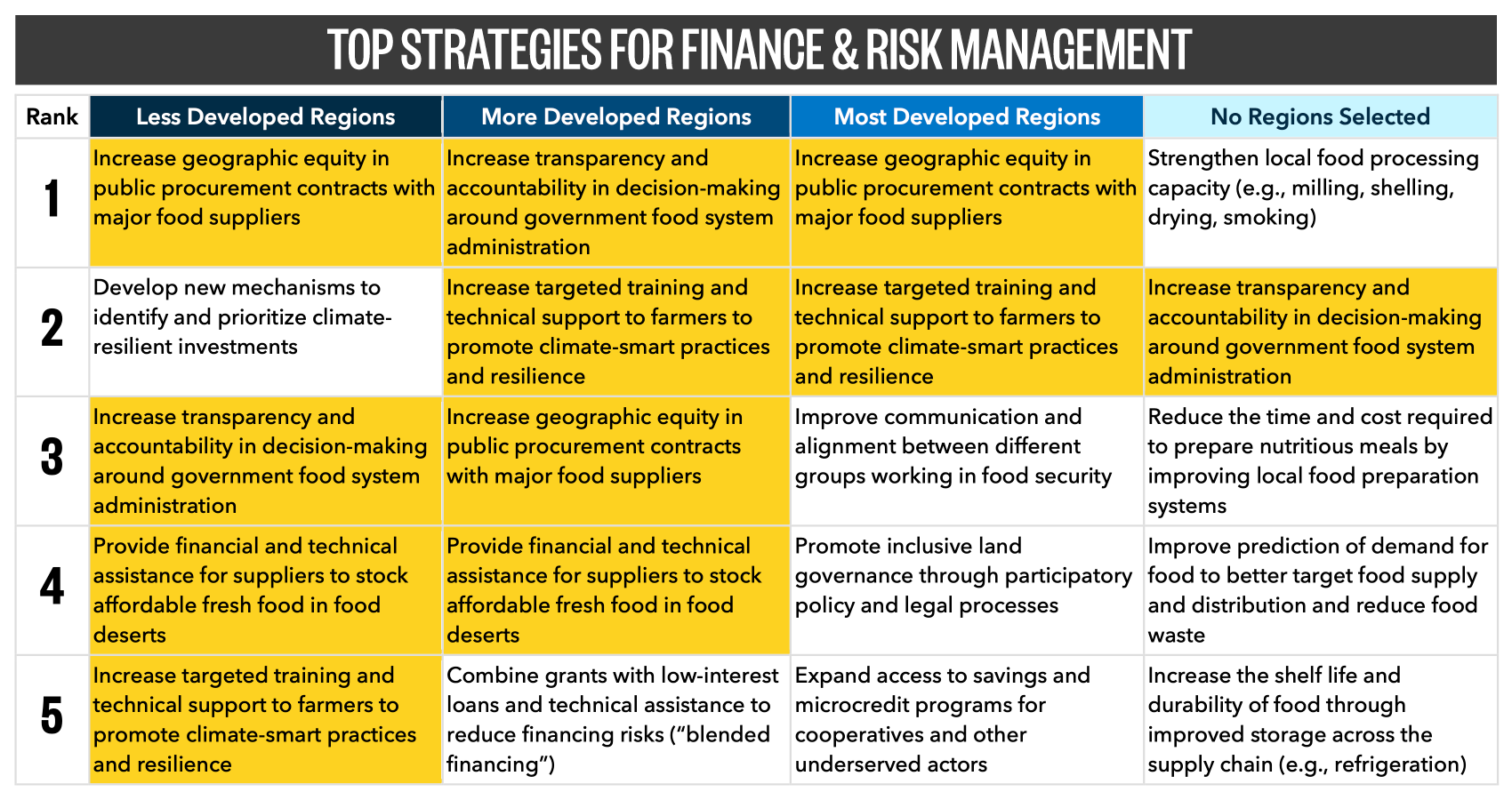

Regional Breakdown of Results

The top five strategies for this challenge were similar across participants working in regions with different levels of development, suggesting a set of cross-cutting priorities. Many of the top strategies across regions focus on enabling a greater diversity of actors in food systems. Interestingly, strategies that might address this challenge’s call to expand capacity and manage economic and climate-related shocks, like improving transportation infrastructure and increased local food system monitoring, were broadly rejected by participants.

Feeding the Future Challenge Spotlight: Finance & Risk Management © 2026 by Aspen Digital is licensed under CC BY 4.0.